https://cargotransinc.com/wp-content/uploads/2025/02/Logistics-4-2000x1250-1.png

1250

2000

Abstrakt Marketing

https://cargotransinc.com/wp-content/uploads/2025/06/CargoTrans-Logo-Color-300x104.png

Abstrakt Marketing2025-02-28 11:28:342025-02-28 11:29:05CT MarketAlert: New Tariffs on Steel and Aluminum Derivative Products Announced

https://cargotransinc.com/wp-content/uploads/2025/02/Logistics-4-2000x1250-1.png

1250

2000

Abstrakt Marketing

https://cargotransinc.com/wp-content/uploads/2025/06/CargoTrans-Logo-Color-300x104.png

Abstrakt Marketing2025-02-28 11:28:342025-02-28 11:29:05CT MarketAlert: New Tariffs on Steel and Aluminum Derivative Products AnnouncedCarrier GRI & Blank Sailing Strategy Mimics Yo-Yo Dieting…

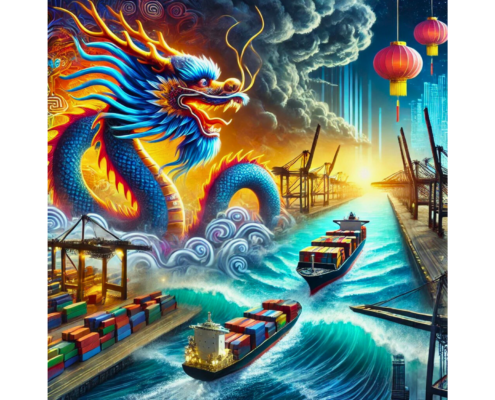

Panama Canal

Starting this November, the Panama Canal Authority will reduce daily transits from 36 to 31, potentially introducing delays of 2-3 days for container services. However, even with these delays, it remains a quicker route for most Asia ports than the Suez Canal. For time-sensitive and heavy cargo, consider alternative routes via the U.S. or Canadian West Coast or explore rail and trucking options.

Market rates are lower than pre-pandemic market as carriers try to implement blank sailing strategy.

Carriers continue to flex their blank sailing muscle to manage capacity and rates. Carrier discipline will determine how effective the Nov GRI is and how long it will stick. Creating artificial demand has not proven to be a successful strategy for the carriers.

TAC Index data shows rates out of China to the US up 6%, and up 4.6% to Europe, in the past month – but, out of Hong Kong, rates grew 14% to North America, and 9.7% to Europe.

Freightos’ FAX shows bigger jumps: rates from South Asia to North America have jumped 12.5% since the start of October; and there was a hefty 21% rise from South Asia to Europe – in the 100kg to 300kg category.