https://cargotransinc.com/wp-content/uploads/2026/01/tariff-on-us-products-scaled.jpg

1438

2560

Oriol F5

https://cargotransinc.com/wp-content/uploads/2025/06/CargoTrans-Logo-Color-300x104.png

Oriol F52026-01-21 12:19:272026-01-21 12:19:28Tariff on US Products 2026: Preparing for Trade Shifts

https://cargotransinc.com/wp-content/uploads/2026/01/tariff-on-us-products-scaled.jpg

1438

2560

Oriol F5

https://cargotransinc.com/wp-content/uploads/2025/06/CargoTrans-Logo-Color-300x104.png

Oriol F52026-01-21 12:19:272026-01-21 12:19:28Tariff on US Products 2026: Preparing for Trade ShiftsWho Pays Export Duties? A Guide for Shippers on Trade Compliance

The world of international trade is governed by a complex web of duties, tariffs, and taxes. A common point of confusion for businesses engaged in cross-border logistics is determining who pays export duties—the exporter, the importer, or someone else?

Understanding these responsibilities is crucial for accurate cost forecasting, smooth customs clearance, and maintaining compliance. For shippers, knowing your role is essential to avoiding unexpected delays and charges.

At CargoTrans Inc., we provide reliable, efficient logistics, and we equip our clients with the visibility tools needed to navigate these complexities, ensuring your supply chain remains optimized from end to end.

Understanding the Fundamentals: Export vs. Import Duties

To answer the core question, we must first distinguish between the two primary types of trade taxes:

- Export Duties (Rare but Relevant)

- Definition: A tax or levy imposed by a country’s government on goods leaving its territory.

- Purpose: Typically used to restrict the outflow of certain natural resources or goods to ensure sufficient domestic supply, or as a revenue source on monopolistic goods.

- Payer: Generally paid by the exporter (the seller in the exporting country), as the tax is levied at the point of exit.

- Import Duties (The Most Common Tax)

- Definition: A tax imposed by the importing country’s government on goods entering its territory. These are the tariffs most commonly discussed in international trade.

- Purpose: To protect domestic industries, retaliate against unfair trade practices, or generate government revenue.

- Payer: Generally paid by the importer (the buyer in the importing country).

Who Pays Duties: Importer or Exporter? The Incoterms Deciding Factor

While the fundamental rules exist, the practical answer to who pays duties importer or exporter hinges entirely on the Incoterms (International Commercial Terms) agreed upon in the sales contract.

Incoterms define the division of costs and risks between the seller (exporter) and the buyer (importer).

- Incoterm Rule

- FOB, EXW, FCA (Departure)

- CFR, CIF, CPT, CIP (Main Carriage Paid)

- DAP, DPU (Arrival)

- DDP (Delivered Duty Paid)

- Responsibility for Import Duties/Taxes

- Importer (Buyer)

- Importer (Buyer)

- Importer (Buyer)

- Exporter (Seller)

- Who Pays Duty on Exported Goods (If Applicable)

- Exporter (Seller) or Buyer, depending on contract

- Exporter (Seller)

- Exporter (Seller)

- Exporter (Seller)

The Critical Need for Transparency: Managing Tariff Costs

Regardless of whether you are the importer or the exporter, a lack of clarity on duties and tariffs leads to risks:

- Customs Delays: Unpaid or misclassified duties halt shipments.

- Unexpected Costs: Surprises on the final bill erode profit margins.

- Compliance Penalties: Failure to report accurately can result in fines.

This is where visibility and proactive tools become invaluable for shippers.

Leveraging Your Control Tower for Duty Management

As a CargoTrans Inc. client, you gain strategic advantage through our digital tools integrated with your freight forwarding service:

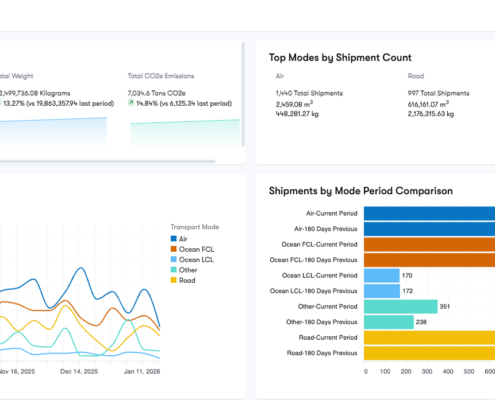

- Captain Control Tower Dashboard: Our end-to-end visibility platform gives shippers a clear, centralized dashboard for tracking every shipment. While its primary focus is movement visibility, it provides the essential context needed for duty management. Proactive alerts regarding arrival windows give you ample time to prepare the necessary documentation and funds for duties.

- Captain Tariff Tracker: This specialized tool provides key insight supply chain solutions by allowing you to:

- Research Applicable Tariffs: Get an initial understanding of the duties likely to be applied based on the Harmonized System (HS) code.

- Forecast Landed Costs: Better predict the total cost of goods, factoring in potential duties and taxes, crucial for DDP shipments.

- Stay Ahead of Changes: Monitor current and pending tariff updates, addressing the issue of who pays export duties or import duties when regulations shift.

By having clear, real-time data on your shipments and the associated tariffs at your fingertips, you move from reactive confusion to proactive compliance.