MARKET UPDATE: DECEMBER 6TH, 2024

CT MarketWatch: The Calm Before the Uncertain Tariff Storm

As the holiday season approaches, the global logistics market is navigating a dynamic landscape shaped by seasonal demand surges, geopolitical uncertainties, and shifting operational strategies. Sea freight trends show mixed signals, with North America navigating tariff-driven uncertainty, South America experiencing tighter space and rising demand, and Europe seeing stable rates buoyed by pre-holiday shipments. The Asia-Pacific region grapples with rate declines on some routes amid carrier competition, while transatlantic freight demand remains strong, driven by year-end deadlines. Air freight markets face capacity constraints and rising rates, fueled by peak holiday activity and global trade shifts. This update highlights key trends and insights as stakeholders prepare for the year-end surge and the transitions ahead in 2025.

MARKET WATCH

Ocean Freight

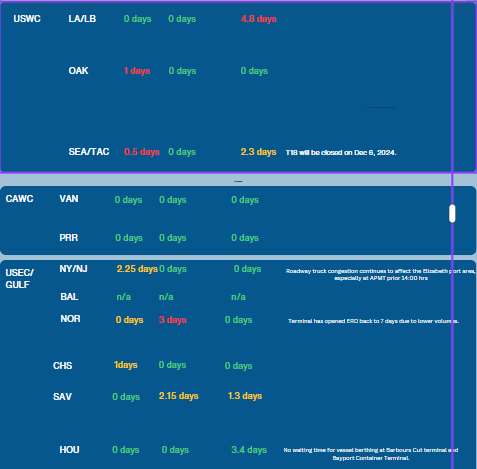

North America

-

Container Market Overview:

The North American container import market remained subdued during the Thanksgiving holiday week. The industry saw a period of calm, with market participants showing caution amid tariff uncertainties. Rates on West Coast routes softened further, while East Coast rates remained relatively steady, reflecting tighter capacity.

-

Market Insights:

- Tariff Watch: Anticipation surrounding the upcoming 25% tariff on imports from Mexico and Canada, effective January 20, continues to create uncertainty.

- Carrier Activity: Several major carriers have extended Freight All Kinds (FAK) levels until mid-December, signaling no immediate General Rate Increase (GRI).

- Volume Trends: Market hesitancy persists as shippers await clarity on tariff implementation and its impact on specific industries.

South America

-

Container Market Overview:

The South American market showed minimal activity with steady rates across key trade lanes. However, expectations for increased cargo volumes in December are fueling optimism.

-

Key Observations:

- North Asia to South America: Space tightened as volumes normalized, particularly on the West Coast South America route.

- East Coast South America: Strong expectations of a December GRI are shaping customer sentiment, though dissatisfaction with current offerings remains evident.

Europe

-

Container Market Overview:

The European market displayed signs of optimism heading into December, buoyed by early Christmas cargo shipments. Fronthaul rates saw notable increases, stabilizing later in the week.

-

Market Dynamics:

- Fronthaul Activity: Rates on Asia-to-Europe fronthaul routes surged early in the week, with carriers targeting further increases in December.

- Backhaul Stability: Mediterranean-to-North Asia routes experienced slight rate adjustments, reflecting efforts to stabilize the market ahead of the holiday season.

Transatlantic

-

Ocean Freight Trends:

Demand remains robust for both North and South Europe trade lanes, with clients prioritizing earlier sailings to meet pre-January deadlines.

-

Operational Impacts:

- Blank Sailings: Programs for Weeks 47–52 have created a backlog as carriers attempt to manage heightened demand.

- Rate Stability: Rates remained stable across North and South Europe, continuing the trend observed in November.

Air Freight

Key Market Drivers:

- Europe to Americas: Significant rate surges were observed, particularly to South America and Brazil, driven by congestion and capacity reductions.

- Global Spot Rates: Spot rates rose globally, reflecting strong demand and limited capacity, especially during peak holiday shipping.

- Asia-Pacific Stability: Effective planning in Asia tempered peak season volatility, maintaining relative stability despite reduced capacity.

Outlook

The upcoming tariff implementations and seasonal surges are set to influence demand and pricing dynamics as we move into December. Stakeholders are advised to monitor carrier announcements and prepare for potential rate adjustments.

📰 IN OTHER NEWS…

U.S. Adds Nearly 30 Chinese Companies to Forced-Labor Blacklist

The Biden administration will block imports from more than two dozen Chinese companies over their alleged links to forced labor in the country’s Xinjiang region, its largest-ever expansion of a ban list that took effect in 2022.

Read More

Crew member dies as DHL aircraft crashes at Vilnius, raising security fears.

Concerns over terrorism in Europe heightened this morning after an ageing 737-400F, operating on behalf of DHL, crashed on approach to Vilnius Airport. One crew member died, while three others are in hospital.

Read More

To Challenge China, India Needs to Get Out of the Way of Its Factory Owners

Boosting manufacturing is critical to India becoming an economic powerhouse. It now has a fresh shot at that with the election of Donald Trump, whose promise to levy sky-high import tariffs on Chinese goods could send more manufacturers to the South Asian nation.

Read More

E-commerce to drive air cargo industry expansion through 2043

MIAMI BEACH, Fla. – Express shipments will account for a quarter of all air cargo business by 2043 as e-commerce sales growth outpaces general cargo by a wide margin, contributing to a two-thirds increase in the global freighter fleet to meet shipping demand, according to Boeing’s latest outlook.

Read More

MSC adds even more port calls to its 2025 standalone network

MSC is doubling down on its 2025 strategy of offering shippers and forwarders as many port pairs as possible after publishing today an updated proforma 2025 network schedule.

Read More

More blanked voyages expected as carrier efforts to drive up rates falter

Container spot rates were largely unchanged for a third consecutive week, as it became evident that a 15 November rate hike on Asia-Europe trades had failed to have anything more than a marginal impact on pricing.

Read More

Trump vows 25% tariff on imports from Canada/Mexico and adds 10% to China

News that US president-elect Donald Trump has mandated 25% tariffs on all products from Mexico and Canada and an extra 10% on Chinese products has sent the supply chain into a spin.

Read More

Truck driver shortage in Europe at crisis level – and is set to get worse

Europe’s road freight industry continues to suffer from a crippling driver shortage crisis, with around half a million vacancies.

According to the International Road Transport Union’s (IRU) annual driver shortage analysis, driver vacancies in Europe represent around 12% of all positions, and was broadly the same last year, largely due to depressed economic activity.

Formalised entry – the ecommerce conundrum facing the US

Formalising ecommerce shipments into the US is “not if, but when”, as current cross-border traffic “is creating safety, security and economical risks” – but the sheer volume of parcels would make this a daunting task.

Read More

US retailers ramping up year-end imports ahead of strike, tariff threats

US retailers in November and December plan to import 350,000 TEUs more than they had expected a month ago as they rush to bring merchandise into the country ahead of a possible strike in January by East and Gulf coast dockworkers and billions of dollars in new tariffs proposed by President-elect Donald Trump.

Read More

Have you met Captain?

Our End-to-End Visibility Platform

Visibility done right so that you can manage compliance, budget and expectations. Empowering you to confidently control your supply chain and deliver happiness to your customers.

We are ready to help

Logistics Solutions at your fingertips

We have team members ready to answer your questions.

Give us a call 516.593.5871 or chat on our website 💬