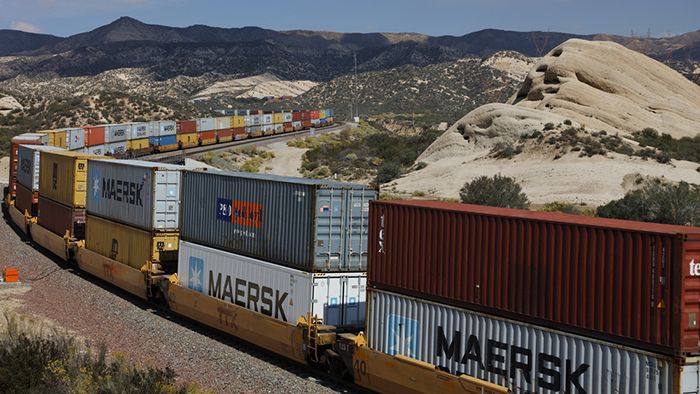

Congestion, COVID and lack of capacity. When is my container going to arrive? Industry experts say that there is no end in sight to the current crisis at West Coast ports. An import surge continues to cause supply chain delays all the way downstream. CargoTrans is navigating these murky waters to guide and direct clients through the delays and exceptions of the new year and across all modes of the supply chain. Stay agile and informed about the conditions on the ground and let CargoTrans help you adjust plans as needed.

Here is a rundown of the current situation:

COVID

COVID remains a disruptive factor at sea and on land. The contagion has disrupted vessel operations, which has compounded scheduling issues. A shortage of labor at the ports, trucking companies and warehouse facilities has increased operational challenges and contributed to inland bottlenecks. Labor shortages are a factor in elevated costs because drivers and other logistics workers are now demanding higher wages and benefits.

Origin

Container shortages remain a pressing issue in Asia and that is adding to the slowdown stateside. Shortages have forced shippers to substitute 20’ containers for 40’ containers which leads to double the number of moves needed to unload, eating up precious time at the dock at destination.

Port Operations

PNW

Prince Rupert Terminal

Vessel wait times – Trending up (5-6 days)

Yard capacity – Trending up (Beyond capacity) Empty containers are being moved off dock if not evacuated within 7 days.

Rail dwell – Steady (3.5 days) Increased train departures planned.

Vancouver/Centerm

Vessel wait times – Trending up (7 days)

Yard capacity – Trending up (98%)

Rail dwell – Trending up (5.8 days)

Southern California

At any time, there are 30-35 vessels seeking anchorage in Southern California ports, waiting an average of 10-15 days to berth.

APM Terminals Pier 400 Los Angeles

Vessels alongside – Extended port stays of 3 days.

Yard capacity – 95%

Import dwell average – 7-8 days

TTI Long Beach

Vessels alongside – Extended port stays of 3 days.

Yard capacity – 79%

Import dwell average – 7 days

Oakland

Labor shortages disrupting port operations.

4 new cranes are being installed.

Southern California Trucking Update

Limited appointments and chassis availability.

Appointments at Southern California terminals must be scheduled as early as possible to avoid discharge delays.

West Coast Rail Update

Despite continuously high volumes, the network is fluid. Congestion due to high volumes is expected to continue until the end of January. Volume restrictions continue within the network in order to reduce congestion.

Vancouver

On-dock rail dwell time – 6.2 days (CN), 5.2 days (CP)

High yard utilization, railcar supply remains strong.

Long Beach Pier T and Los Angeles Pier 400

On dock rail dwell – 6 days (Pier 400), 9 days (Pier T)

Railcar equipment remains tight. Expect greatest delays to Fort Worth and Memphis.

Rail ramp connections continue to experience delays due to reduced chassis and trucking capacity. Holiday backlog and rising COVID cases add to delays.

East Coast Rail Update

Newark

Rail cargo from both APM Terminals and PNCT remain fluid.

On dock rail dwell – 5 days (APM), 5+ days (PNCT).

High volume and limit chassis at Elizabeth Marine Terminal is resulting in elevated dwells.

Terminal Update

Drayage capacity is expected to remain extremely strained for Q1 at the Port of LA/LB. Chinese New Year has historically been a time when Chinese factories shut down for the holiday and US ports would normally have the opportunity to play catch-up. There will be no rest for the weary. Many factories in China will not shut down during the holiday due to booming American demand, depriving ports of an opportunity to regain their footing.

Ask the CargoTrans team how to take control of your shipments and achieve supply chain visibility amid the disruptive conditions of the new year.