Americas

Panama Canal

The ongoing drought and restrictions at the Panama Canal are expected to continue into the first half of 2024. However, transit times are improving, with a decrease in the number of vessels waiting for slots. Many services are being diverted to the Suez Canal or around the Cape of Good Hope. Consider alternative routes and anticipate longer transit times, delays, and rate increases in the coming weeks.

2M Alliance (MSC and Maersk)

Carriers have a high priority for booking slots for Panama Canal transit, so the majority of their vessels will continue to head through the canal. The exception is ZIM’s standalone ZXB service, which sails via the Cape of Good Hope due to concerns about recent attacks on commercial shipping by Houthi rebels.

Ocean Alliance(CMA, OOCL, COSCO, Evergreen)

Has priority on certain services. Cosco’s AWE4 to NYC/SAV/CHS and GME service to Gulf ports are most likely to be diverted to the Suez Canal.

THE Alliance (Hapag, HMM, ONE and Yang Ming)

Has low priority to book slots of the Panama transit, so the carriers have started to divert EC1/EC2/EC6 to transit through the Suez Canal (some backhaul sailings are going around the Cape of Good Hope) for medium and long term.

Looking ahead…

We’d like to remind you that the most significant impact of the Panama Canal disruption may be felt in January when many vessels may not return on time due to extended transit times, whether waiting at the Panama Canal, transiting through the Suez Canal, or sailing via the Cape of Good Hope.

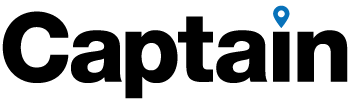

Announced Panama Canal Surcharge:

Carriers will implement the Panama Canal Surcharge (PCC) / the Panama Canal Low Water Surcharge (PLW) that will come into effect from December 15, 2023.

*** It is important to note that the Panama surcharge will be applied to all containers transiting the Canal, whether it be overweight cargo or light cargo.

Sea Freight

Origin: Asia

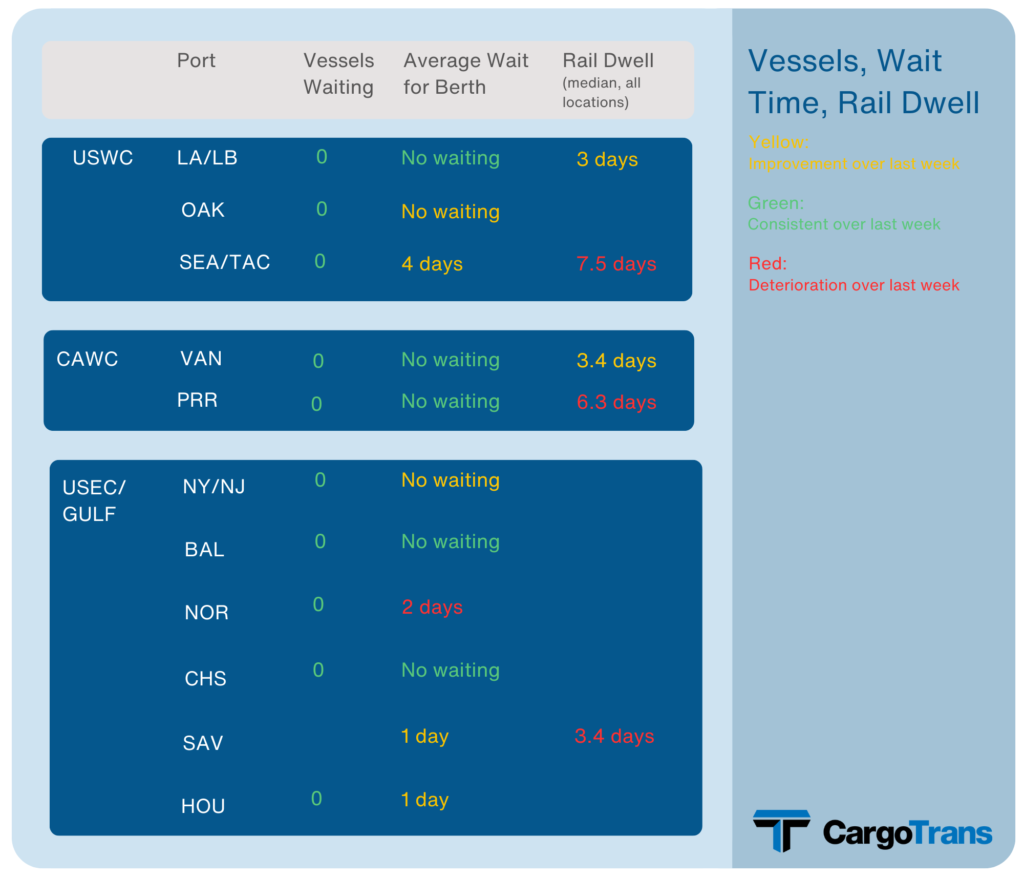

Carriers are implementing a new round of GRIs starting from December 15. The announced GRIs are $200 to $300 per FEU for USWC and approximately $600 per FEU for USEC. This will raise new rate levels to $1700 – $1800 for USWC, $2900 – $3000 for USEC, and $3200 – $3300 for GULF in the second half of December. With the effective USEC capacity reduction due to service diversions and an uptick in demand before the Chinese New Year (CNY) starting on February 10, ocean carriers are likely to maintain the mid-December and January 1 GRIs.

Alert!

2/9-2/15 Lunar New Year / Spring Festival

PLEASE REACH OUT TO OUR TEAM TO PRE-BOOK SPACE AS CARRIERS REMOVE CAPACITY

Need Help Navigating the Current Freight Market? Contact our Procurement Team

In Other News…

- Logistics companies race to adapt to shifting supply chains – Carriers in ocean, air cargo, rail and trucking are launching new services and tweaking their networks amid evolving global trade flows.

– Read More - Shipping’s exodus from parched Panama in full flow – The transit backlog at the interoceanic waterway today numbers just 77 ships, 13 below the average since the 2016 expansion of the locks, and down by more than 50 vessels in the space of just a fortnight. For those in the queue, however, wait times are long, especially for ships waiting for a northbound convoy where average wait times topped out at over 15 days earlier this week and currently stand at 14.5 days.

– Read More - FedEx sends security alert to contractors amid thefts during busy season – FedEx Corp. has sent a security warning to contractors, asking them to give priority to the safety of their drivers and to keep an eye on their vehicles, the Wall Street Journal reported late Thursday, citing a document it viewed. The peak season for deliveries “is showing an increase in unlawful activity, putting increasing concern on safety and security,” according to the alert, which also had a list of safety tips to contractors, the Journal said. Videos of carjackings and thefts from delivery trucks have been posted on social media and aired on television.

– Read More - Houthis widen ship targets – On Saturday, Yemen’s Houthi movement said they would target all ships heading to Israel, regardless of their nationality, and warned all international shipping companies against dealing with Israeli ports. The Houthis have attacked and seized several Israeli-linked ships in the Red Sea in recent weeks in reaction to the ongoing war in the Gaza Strip. The US has been discussing creating a naval convoy with allies, while also seeking out ways to limit Houthis’ access to cash.

– Read More - Amazon seller fees target low inventory, inbound transportation costs – The company said the added fulfillment charges will average $0.15 per unit sold once they take effect next year.

– Read More

Questions? All you have to do is contact us.